Your last year’s fitness activity may soon determine your health insurance premium. The insurance regulator has floated a draft proposal that will allow insurers to give premium discounts in health insurance for those living a fit lifestyle.

You may also get a higher sum insured compared to others if you maintain an active fitness regime.

Insurance companies will be allowed to specifically offer wellness and preventive benefits to customers. In an exposure draft on wellness and preventive benefits, Insurance Regulatory and Development Authority of India (IRDAI) has said that such special features can be offered in the policy contract.

Currently, health premiums are based on the claims experience of the previous year for that specific age group. Those having a history of medical ailments are charged higher.

The IRDAI draft guidelines said that the costs towards the wellness services has to be factored into the pricing of the underlying health insurance product. This will also have to filed with the regulator when filing a health product.

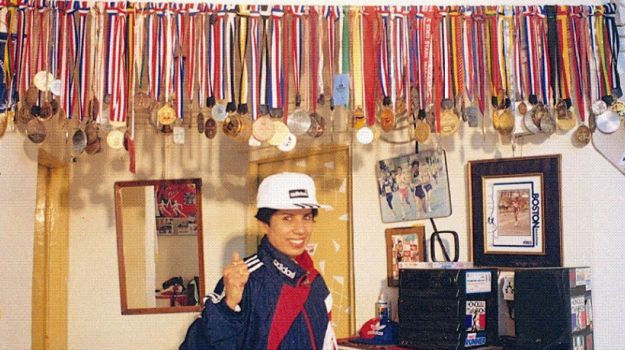

Among the permissible services are discounts on health check-ups and pharmaceuticals, redeemable vouchers to obtain protein and other health supplements. The wellness benefit can also include redeemable vouchers for membership in yoga centres or gymnasiums for participating in fitness activities.

Over and above this, discounts on premiums and/or increase in sum insured at the time of renewals based on wellness regime followed by policyholders in the preceding policy period will be allowed.

However, IRDAI said that an increase in sum insured will be independent and shall not be linked to the cumulative bonus offered, if any.

The insurance company will not be liable for the quality of products and services offered by any third party under this benefit.

The concerned stakeholders have time till November 18 to offer their suggestions on the draft. After this, the guidelines will be finalised.

[“source=moneycontrol”]